INDIA IMPOSES MAJOR RICE EXPORT BAN, TRIGGERING INFLATION FEARS

India on Thursday ordered a halt to its largest rice export category in a move that will roughly halve shipments by the world's largest exporter of the grain, triggering fears of further inflation on global food markets.

The government said it was imposing a ban on non-basmati white rice after retail rice prices climbed 3% in a month after late but heavy monsoon rains caused significant damage to crops.

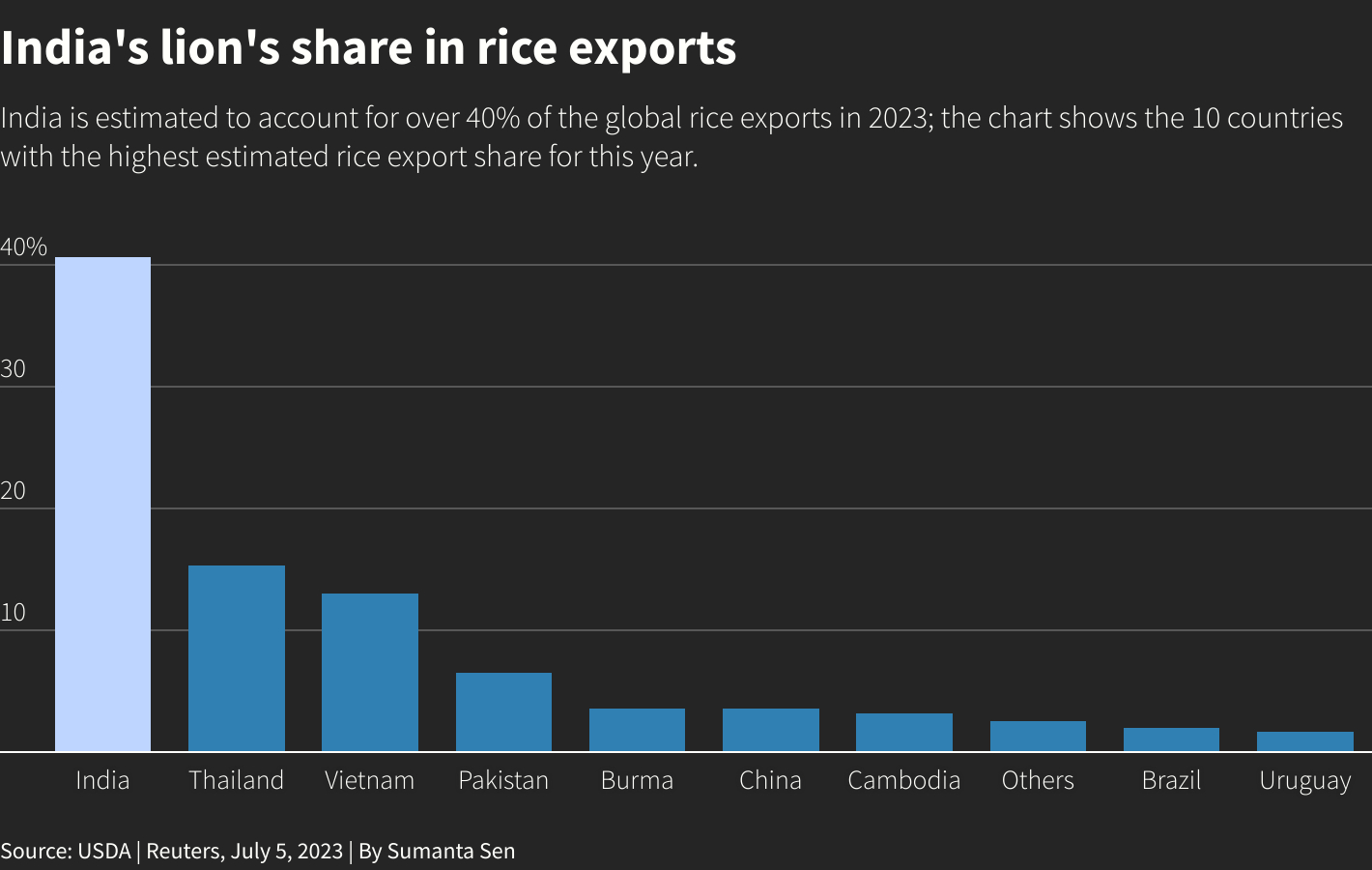

India accounts for more than 40% of world rice exports, and low inventories with other exporters mean any cut in shipments could inflate food prices already driven up by Russia's invasion of Ukraine last year and erratic weather.

"In order to ensure adequate availability of non-basmati white rice in the Indian market and to allay the rise in prices in the domestic market, the government of India has amended the export policy," the food ministry said in a statement that cited a 11.5% increase in retail prices over 12 months.

The category impacted, non-basmati white and broken rice, accounted for around 10 million tons of a total of 22 million tons of Indian rice exports last year.

The government clarified late on Thursday that parboiled rice, which represented 7.4 million tons of exports in 2022, was not included in the ban.

The move demonstrates the sensitivity of the government of Prime Minister Narendra Modi to food inflation ahead of a general election nearly next year.

His administration has extended a ban on wheat exports after curbing rice shipments in September 2022. It also capped sugar exports this year as cane yields dropped.

"India would disrupt the global rice market with far greater velocity than Ukraine did in the wheat market with Russia's invasion," B.V. Krishna Rao, president of the Rice Exporters Association told Reuters.

Rice is a staple for more than 3 billion people, and nearly 90% of the water-intensive crop is produced in Asia, where the El Nino weather pattern usually brings lower rainfall. Global prices are already hovering at their highest level in 11 years.

"The sudden ban on exports would be very painful for the buyers, who can't replace the shipments from any other country," Rao said.

Reuters Graphics

While Thailand and Vietnam don't have enough inventories to plug the shortfall, African buyers would be most affected by India's decision, Rao said, adding that many countries will urge New Delhi to resume shipments. Other top buyers of Indian rice include Benin, Senegal, Ivory Coast, Togo, Guinea, Bangladesh and Nepal.

The ban would be effective from July 20, but vessel under loading would be allowed for exports.

WEATHER DAMAGE

Heavy rain in northern parts of India over the last few weeks has damaged newly planted crops in states including Punjab and Haryana, and many farmers have had to replant.

Rice paddy fields in northern states have been submerged for over a week, destroying newly planted seedlings, and forcing farmers to wait for waters to recede so they can replant.

In other major rice-growing states, farmers have prepared paddy nurseries but have been unable to transplant the seedlings due to inadequate rainfall.

The area under rice cultivation had been expected to increase after New Delhi raised the rice purchase price, but farmers so far have planted rice paddy on an area 6% smaller than in 2022.

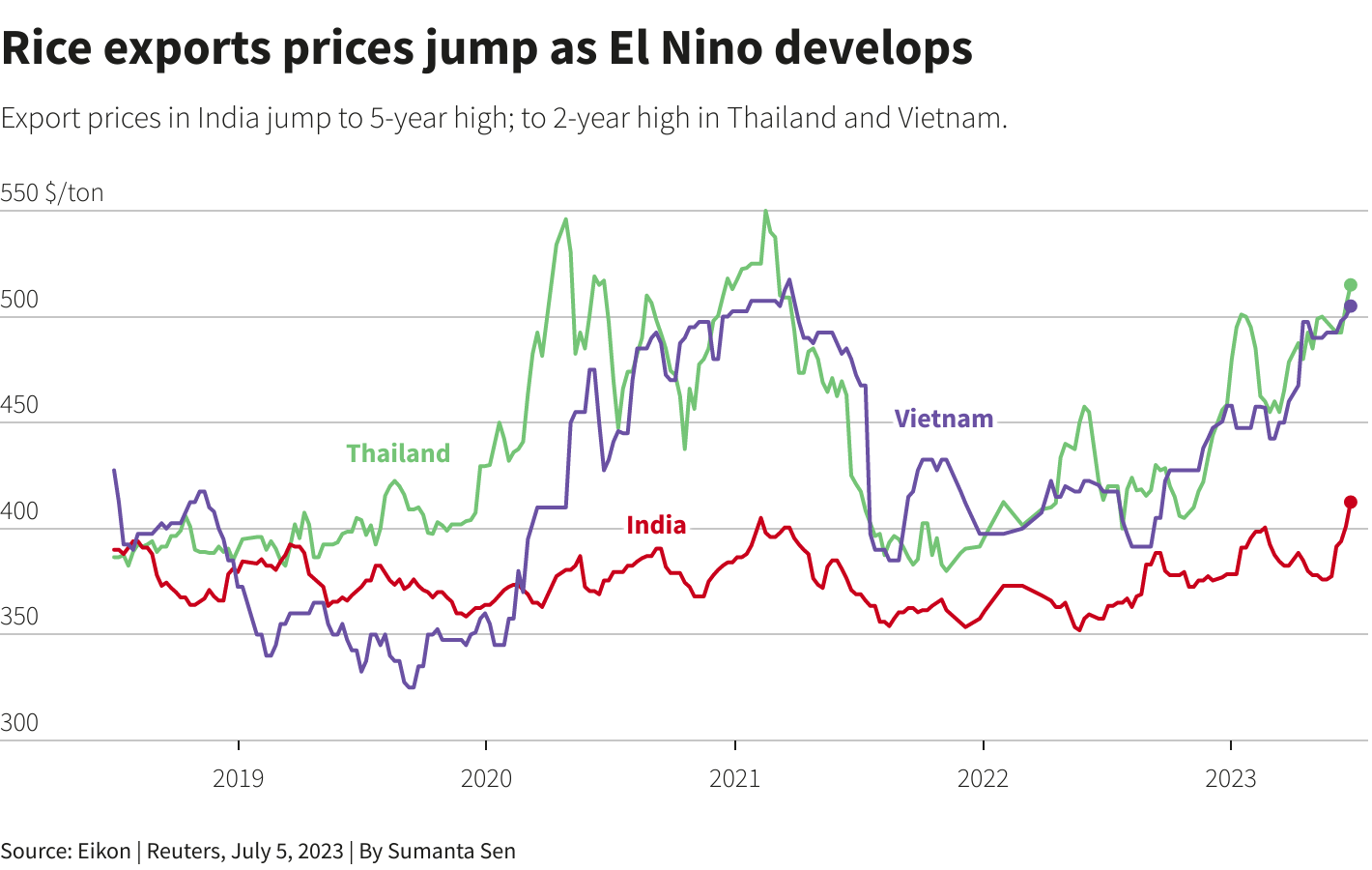

This week, prices of rice exported from Vietnam, the world's third-largest exporter after India and Thailand, soared to their highest in more than a decade on growing supply concerns due to El Nino.

Vietnam's 5% broken rice was offered at $515-$525 per metric ton - its highest since 2011. India's 5% broken parboiled variety hovered near a five-year peak at $421-$428 per metric ton.

Reuters Graphics

Reuters Graphics

Buyers may move to Thailand and Vietnam, but their 5% broken rice could cost $600 per metric ton, said one European trader.

China and the Philippines, who generally buy Vietnamese and Thai rice, will be forced to pay substantially higher prices, another European dealer said.

Source: Reuters