SOARING GLOBAL DEMAND DRIVES RICE EXPORTS HIGHER

Vietnam has exported six million tons of rice worth US$3.2 million this year, 21% and 35% up in terms of volume and value from the same period last year.

Farmers harvest rice in Mekong Delta's Soc Trang Province. Photo by VnExpress/Nguyet Nhi

The buyers have been countries in Asia, the Middle East and West Africa, data from the General Department of Vietnam Customs shows.

The Philippines has remained the biggest customer, buying nearly US$1.23 billion worth of the grain, a 16% increase year-on-year.

It was followed by China with $452 million, a 67.9% jump.

Indonesia climbed from eighth position last year into the top three, with its imports rising by 1,505% to 718,266 tons and costing $361.2 million.

According to the Vietnam Food Association (VFA), many countries have increased purchases fearing a supply shortage in the world market.

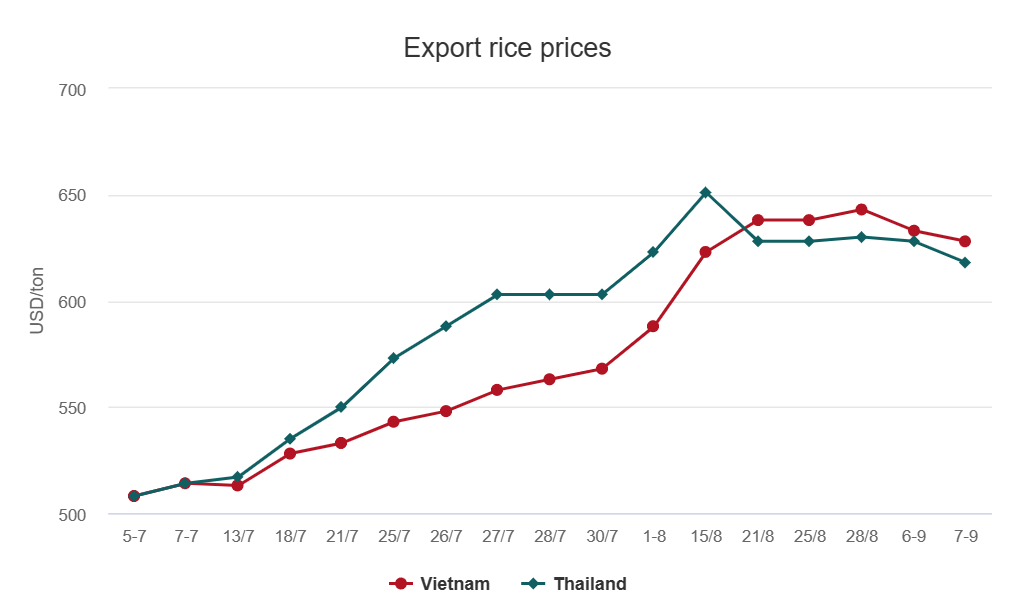

In the last three months, after India banned rice exports on July 20, Vietnam’s exports have soared.

A week after India's ban, the UAE and Russia also announced they would stop exporting rice, and many countries flocked to Vietnam to buy, also driving up prices.

Besides the export bans, there have also been adverse weather, droughts and floods that have affected rice production in many countries, the VFA said.

Indonesia has been making bid after bid to buy rice from Vietnam and Thailand.

At the beginning of the year it had announced plans to import two million tons to ensure food security and cope with the El Nino phenomenon. Recently it tweaked the figure to 2.4 million tons.

By the end of July it had imported around 1.4 million tons.

The director of a rice export firm in the Mekong Delta’s Can Tho City said Indonesia favors Vietnamese rice because of its high quality.

On September 11 Indonesia announced it would buy 300,000 tons of 5% broken white rice from Vietnam, Thailand, Pakistan, and Cambodia, and businesses in Indonesia are also offering to increase the amount of rice they buy from his company, he said.

Other countries such as Senegal, Poland, Ghana, and Gabon have also stepped up imports of Vietnamese rice because they cannot buy from India and domestic production has been hit by drought.

The Ministry of Industry and Trade has forecast a jump in exports in the last four months of this year due to orders from many new markets.

However, export businesses are worried that supply might not be enough to meet the demand.

At a conference in Can Tho last month, Nguyen Viet Anh, general director of Orient Food And Packaging Co. Ltd, had expressed these worries.

He had quoted data from the U.S. Department of Agriculture showing that Vietnam's inventory-to-consumption ratio was only 11% as against a recommended level of 22%.

This ratio has fallen further to just 8.5% after India's ban on rice exports.

Anh had said: "Enterprises are grappling with the problem of farmers overselling their produce. The number of brokers in the market is rapidly increasing, causing disruptions and financial losses for many enterprises."

Not only do they lose their deposit money, but are not even able to buy from previously affiliated farmers, he had added.

This month many businesses exporting rice to the Philippines have said that farmers and traders have repeatedly asked to cancel contracts or extend them because the government has set a ceiling for rice prices.

In the last two days both export and domestic prices have decreased, the former by $15 per ton from last week and the latter by VND100-600 per kilogram.

Source: VnExpress